|

What's Happening

Intel’s earnings report was better than expected, but did not

provide the silver bullet statement that the future was bright

and that all the bad news was over. Instead, the company

continued to be very cautious, and cut its own capital spending

plans more aggressively than expected. This threw some cold

water on the tech sector in the after hours setting, and it

followed into Europe and Asia.

The pre-market futures were once again flat. Crude oil was

rallying, as traders set positions up for a potential surprise

in the supply figures from the American Petroleum Institute and

the Department of Energy, both to be released at 09:00 on 1-16.

Earning reports from Yahoo, Apple Computers, Fannie Mae, Bank of

American and Genentech are also likely to influence trading.

Is the market running out of time? It’s possible, and investors

should be wary over the next couple of days as the bulls have

failed to take the upper hand. Thus, the market only has a few

sessions left to make up its mind or risk losing an excellent

chance for a momentum run. As we reported on Monday, our

indicators suggested that this could be a very powerful week for

the bulls as momentum last week was as strong as we have seen in

the last 12 months and sentiment is nowhere near signaling that

a top is here just yet. Little has changed, except that the

market is still waffling. Traditional technical indicators such

as the number of stocks making new highs and the advance decline

line are still giving very positive readings. When placed in the

context of the nice momentum thrust that the market gave us on

January 2nd, where NYSE and Nasdaq ratios of up volume to down

volume were both over 9 to 1, there is only one conclusion to

make barring a very negat! ive external event. The market sho

uld be going higher in the short term. Nevertheless, at some

point if the market continues to fail in its efforts to break

out, it’s only a matter of time before the sellers gain the

upper hand.

In case folks missed it, as time is ticking closer to February,

the action on all sides of the ledger is getting more

aggressive, as global governments are scrambling for any

advantage they can garner before the nearly inevitable U.S.

invasion of Iraq. Stratfor.com reported on 1-14 that its sources

have revealed that a top level Iraqui official will be heading

to Cairo to attempt to forge some kind of last minute maneuver

such as an Arab summit, or some kind of agreement that will

allow Saddam to step down and leave a hand picked heir in

charge. We suspect that the latter won’t go over well with the

U.S. or Britain, although the lesser powers could do their

trained seal impressions and applaud at least a little in hopes

that war will be averted.

CNN reported on 1-14 that U.S. Air Force pilots will begin to

fly U-2 spy planes over

Iraq in order to help the weapons inspectors. The planes will have U.N.

colors. Meanwhile, according to the Moscow Times.com, Russian

oil company Lukoil will be in Baghdad on 1-15 to negotiate

itself back into a contract which Iraq reneged on based on the

notion that the Russians were being too helpful to the U.S. in

the ongoing pre-war effort. One of

Russia’s fears is that when the

U.S. invades Iraq, its oil companies will lose any influence and

resources that they held under the Hussein regime. In a related

note, the Washington Post reported that Republican senators will

once again be attempting to revive plans to drill in the

Alaska wilderness, something we

pointed was highly likely in our recent Op Ed piece on CBS

Marketwatch and in “Successful Energy Sector Investing.”

The rhetoric is getting increasingly harsh and more countries

are lining up on the U.S. side of the ledger. Stratfor.com

reported on 1-14 that U.S. officials are now inspecting Turkish

bases, a likely prelude to some kind of agreement for their use

in the war against Iraq. Turkey is a key geographical location,

being in the North of Iraq. Chief U.N. weapons inspector Hans

Blix was quoted as warning Iraq that it needed to be more

cooperative or face war. President Bush on January 14, said he

was “sick and tired” of Iraq’s “games,” and warned Hussein of

rising chances of trouble. And perhaps the most significant

development of the day came from Iran, a charter member of the

“Axis of Evil,” when a highly placed National Security official

publicly stated that Iran supported Iraq’s disarmament, but not

a regime change. This was a big move by

Iran, and once again noted that the continued pressure by the

U.S. on Middle Eastern nations

is taking its toll, and that slow! ly but surely, they will

either abs tain from any opinion against the invasion of

Iraq, or in some way support it.

Iran was not alone, as its “Axis of Evil” sibling North Korea

looks closer to coming to the negotiating table albeit kicking

and screaming. On 1-14, we wrote: “We expect North Korea to

continue to bluster and bang its head while the U.S. continues

to use weasel words to get them to the negotiating table. “ Not

a bad little sentence, given that the Chinese are now likely to

slowly move the two sides to the table and some kind of deal

should be worked out. This is another example of a rogue country

whose leader is totally insane finally caving in to the reality

that they could be next. Strange times we live in.

Technical Summary

Chart Courtesy of

StockCharts.com

The S & P 500 is

on the verge of a break out, or a failure. The index is

increasingly close to its 200 day moving average which is near

950, but is not showing signs of being in a hurry to get there.

Support is still at the 900-912 area for the short term. A break

below 900 would reverse any intermediate term up trend. Key long

term support remains at 768-775, the July 23, 2002 and October

2002 lows. Nasdaq is above its 200 day moving average, with the

next resistance being 1500 in the short term. The small stocks

are likely to move along with the general trend of the market,

but have gone nowhere of late.

|

|

|

|

|

Stock Of The Day

Chart Courtesy of

StockCharts.com

The stock is of the day is Applied Materials (NNM:AMAT).

AMAT is the world's largest chip equipment

manufacturer and its action will be crucial in

determining what many tech stocks do in the next few

days and weeks. The stock failed to break above 16 on

1-14, as investors pulled away as they waited for

Intel's earnings. The cut in capital spending by Intel

hit the chip equipment stocks in after hours trading

and extended into

Europe. What investors should watch for is what happens in AMAT and others

Like KLAC and TER as the trading day continues. If

they can either open well or have a good intraday turn

around, we would expect other tech stocks to follow.

|

|

Chart Courtesy of

StockCharts.com

Sentiment, Asset Allocation, and Background Indicator Summary

The CBOE Put/Call ratio was 0.70 on 1-14, again a neutral

number, and not one suggesting major danger. If the P/C ratio

drops rapidly as the market rallies it is usually a signal that

the rally is reaching its end. Readings below 0.5 are of

concern, but not as serious as readings below 0.40. Readings

above 1.0 are bullish. The most recent reading above 1 came on

11-8.

The CBOE P/C ratio for indexes was 1.23 on 1-14 , showing some

improvement. Readings below 0.9 suggest too much bullish

sentiment, just as readings above 2 are usually required to mark

major bottoms.

The VIX and VXN had readings of 26.55 and 41.92 respectively on

1-14. These indexes continue to drift lower suggesting that

complacency is rising. A fall below 20 on VIX and 40 on VXN

would be very negative, especially if the market rallies.

Readings above 40 and 50 are often signs that a bottom may be

close to developing.

Newsletter writers have remained bullish, but again turned less

bullish on January 10. Unfortunately, this influential group is

still too bullish overall which means that the odds of a rally

lasting for an extended period is not very large. This group has

been very wrong since the top in the year 2000. They finally

turned bearish at the October bottom and were once again wrong

as the market rallied. That means that their persistent

bullishness is now something to keep an eye on. In contrast to

the newsletter writers, the futures traders polled by Market

Vane have stayed bearish throughout the bear market, and they

turned more bearish.

Our asset allocation model moved up significantly on 1-10, and

now suggests a 65% exposure to stocks. We suggest caution when

implementing any increase in risk to this market.

Our MASI and MAGI indicators are now neutral increasing the

chances of a short term upward thrust in the market.

The NYSE specialists remained positive in their latest NYSE

Members Report. The data is for the week ending on December 27,

2002. This is a set of very smart investors, and when they turn

positive or negative, it is just a matter of time before the

market follows. For now this remains a positive, but must be

monitored on a weekly basis. Spec data is not useful as a market

timing tool, but is excellent background information.

Chart Courtesy of

StockCharts.com

The Value Line

Index (VLE) is still playing chicken with its 200 day moving

average as it closed right on the line on 1-14. This is an

uncomfortable situation in the market. The index has remained

above its 20 and 50 day moving averages, and if it can close

above the 200 day line, it would be very bullish. If the index

could remain above its 200 day moving average close out the week

and not falter in the next few days that follow, by definition

the long term trend for the broad market will have turned

positive. Resistance is also still present at 1100. There is

support at 985, the 50 day moving average, and 900 below that.

VLE gauges the performance of 1700 stocks, and is not market

capitalization weighted. That means that it is a true picture of

what is happening to a very broad base of stocks, and not just

affected by the movement of one or a few major stocks.

Chart Courtesy of

StockCharts.com

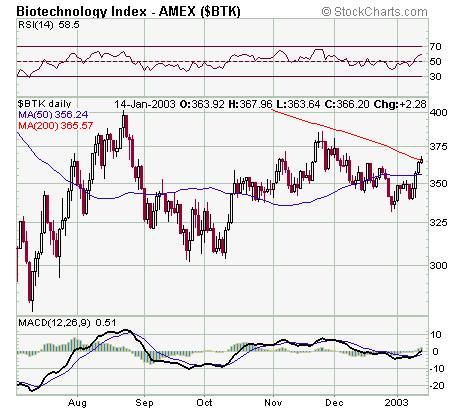

The Amex Biotech

Index (BTK), remained above 360. The index got a nice boost from

the FDA decision to turn favorable on Genzyme for its Fabry’s

disease drug. The next excuse to move the sector will be

earnings, with Genentech due out on Wednesday. Overhead

resistance remains at 380-400, even on a rally above 360. The

340 support level is crucial because if BTK breaks below 340

would be an intermediate term set back. A break below 300 could

take the index to 275. See our premium Health and Biotech digest

for full details and a newly updated list of both long

opportunities and short sales for biotech.

Chart Courtesy of

StockCharts.com

The Amex

Pharmaceuticals Index (DRG) went nowhere again on 1-14. The

index is still struggling to cross above 312 and its 200 day

moving average. This has been tough resistance for the sector,

that is suggesting that a great deal of pent up selling pressure

is still present in this market as key sectors reach important

resistance levels. A sustained close above the key 312 chart

point would be very encouraging. The 320 area for DRG remains

the key. A move above 320 would be a welcome development, as

that would take the index above the 50% retracement point from

the recent bottom, and would be a sign of strength. For a full

description of the ins and outs of investing in biotech and

pharmaceutical stocks check out our book "Successful

Biotech Investing",

available at ama! zon.com, barnesandnoble.com, and bo okstores

everywhere.

Chart Courtesy of

StockCharts.com

The Philadelphia Semiconductor Index (SOX) will

likely head lower, at least in early trading. Intel’s earnings

drove down the chip manufacturing stocks in after hours trading.

If the index can close above 352 if would signal a reversal of

the long term down trend.

Chart Courtesy of

StockCharts.com

The oil complex is once again going to be driven by

news events. Supply statistics will be released on 1-15 at

9:00 A.M. Eastern

time and are likely to influence the short term. The XOI and OSX

indexes were mixed on 1-14. See our energy section for more

details on individual stocks and the latest recommendations on

our highly successful energy timing system using the Oil Service

HOLDRS Trust (OIH).

The Philadelphia Oil Service Index (OSX) will be testing the

support at the 80 level. This remains a sector that it highly

tied to news events, and a trading range could be in place for

several more months. Many of these events and the effects on the

markets were predicted in our latest book "Successful

Energy Sector Investing" (Random House/Prima Venture) .

Chart Courtesy of

StockCharts.com

The Amex Oil Index (XOI) will once again be testing

the support at the 440 area. A break below here would be

negative. A move above 500 for XOI would be a very bullish

development for the energy complex. For immediate analysis,

including stock picks, and the latest in technical analysis of

the entire energy complex, our subscriber section has a full

complement of recommendations in oil service and the rest of the

energy complex.

Chart Courtesy of

StockCharts.com

Small

cap stocks continued to go nowhere. The sector is still being

held hostage by the U.S. dollar, which in turn is being

pressured by the specter of war against

Iraq.

The dollar has broken key short term support, as the Yen and the

Euro are steadily stronger. The SML has stood still over the

last few days and could still move to 210 in the short term, but

only if the overall market improves. The index has failed to

move through short term resistance several times in the last few

weeks, and time is still ticking for the so called January

Effect on small stocks.

The dollar is an important influence on small stocks since this

macro sector of the market tends to rely on domestic business

rather than international money for its earnings. Larger

multinational companies tend to benefit from a weaker dollar as

it aids exports. But the economic weakness is a drag on the

dollar, keeping a lid on small stocks. |